You have been gradually paying off their financial when instantly, you begin providing emails off lenders inviting one to pull out an extra financial. “Make riches!” people say. “Pay money for their knowledge! Redesign your home!”

Hold-up! Before you grab yourself in another mortgage join, let’s take a closer look on next mortgage loans and why they aren’t worth every penny.

What is a second Financial Precisely?

The next home loan occurs when your compromise home equity (by turning it on the a loan) in return for a more quickly solution to repay almost every other bills, over home improvement plans, otherwise buy something your did not otherwise manage.

But it’s personal debt. You ought to pay it back. And since a second financial try covered by the household, you are able to reduce your home if not pay it back. That is some scary articles.

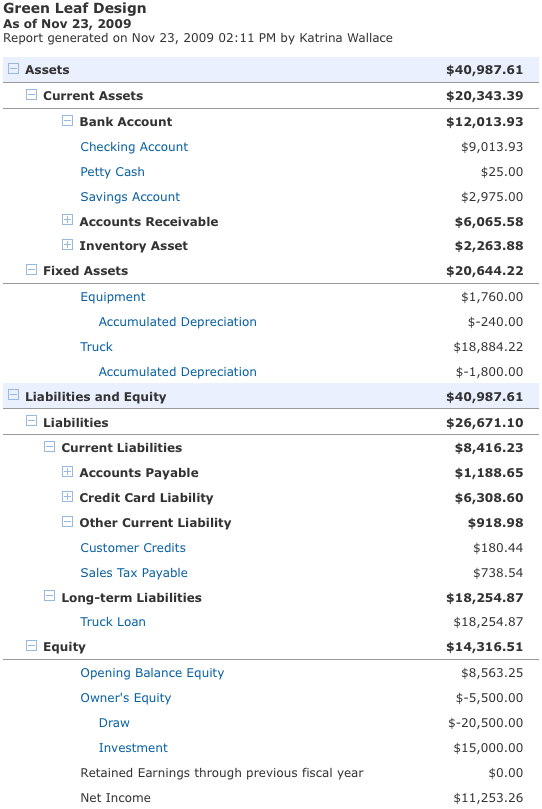

What’s Household Security?

Until you have reduced their financial, that you do not theoretically individual your whole domestic. You own a share equal to the amount you have repaid. Household equity is the fact portion of your residence that is truly your own.

Such, state your home are respected within $250,one hundred thousand therefore owe $150,100000 on your mortgage. To determine your own equity, you might merely deduct $150,one hundred thousand away from $250,000. Meaning your property guarantee would equivalent $one hundred,000.

But that is of course, if this new elizabeth. Normally, industry really worth varies, so your equity often too, dependent on which ways the market industry punches.

How come Domestic Guarantee Come to be an extra Financial?

Really, some tips about what happens: A citizen claims, “You know what? I’ve $a hundred,one hundred thousand during the guarantee. As to the reasons cannot I change you to definitely $a hundred,100000 towards the currency I will used to pay off my personal scholar funds, renovate my house, or carry on vacation?”

Reduced and you will behold, specific bank thinks that’s a good idea and you will responses, “You have your self a package!” The lender agrees to give the latest citizen its collateral if for example the homeowner intends to outlay cash right back which have notice-otherwise hand over their residence when they never.

2nd Financial against. Refinancing: Just how Are they Various other?

Today be careful not to mistake a second home loan having a good refinanced home loan. An additional home loan comes with the second monthly payment as well as your existing payment.

At the same time, refinancing form you are substitution your existing financial with a new home loan who’s an alternate group of terminology-and that means you stay glued to only one monthly payment.

With a second financial, most of your lender keeps the fresh new lien (the fresh legal rights to your home)-when you end and work out repayments (default), they are able to restore your house (foreclosure) https://paydayloanalabama.com/nauvoo/.

The second bank just gets their funds straight back if for example the primary bank will get each of their money back away from auctioning from the home.

All this to say, the second bank try using up increased exposure and can most likely charge you a high interest as a result compared in order to carrying out a great refinance.

Is Next Financial Pricing Highest?

Do you connect one to? 2nd mortgage rates try notoriously more than the ones from an effective refi-as well as a primary mortgage! Quite simply, 2nd financial prices are expensive and sustain your in debt offered.

At the same time, you aren’t (usually) going subsequent into obligations which have good refi. In reality, if you refinance the proper way for the ideal factors (a far greater interest and you may a shorter title), you’ll save thousands inside interest and pay off the household ultimately.

Types of Next Home loans

- Domestic equity financing. Having a home collateral mortgage, their bank will give you a collection of money according to the equity, while pay-off the lending company monthly. Because it is a one-big date lump sum, home collateral financing come with a predetermined rate of interest, very monthly obligations do not changes.