The members, Patty and you will Bryan, utilized their residence’s equity to convert their outdated domestic toward a beneficial room perfect for their big nearest and dearest. It decided, why purchase somebody else’s dream household after they could upgrade their own? With a bit of help from united states, it made use of property security loan to carry their house to their full possible-and you may wow-the results chat to the themselves.

*Annual percentage rate = Annual percentage rate in the 80% loan to worth. Rates energetic ount from $5, is required. $5, in the the newest money is required whenever refinancing a current Professionals very first Family Guarantee Loan. Try words: For those who borrow $31,100000 from the cuatro.99% Apr getting good 10-season name, their projected monthly payment tends to be $. For many who borrow $31,100000 from the 5.74% Annual percentage rate to have a good 15-season name, your projected payment per month is generally $. Rates derive from creditworthiness along with your home’s loan-to-really worth. Number 1 residence just. Property insurance is expected. Pennsylvania and you may Maryland residences only. To have non-players, you’ll end up expected to subscribe Professionals first to generally meet qualifications criteria.

**100% resource can be acquired with the a great priple terminology: For individuals who obtain $30,000 within % Annual percentage rate getting a great 20-12 months name, the estimated payment could be $. Almost every other limitations or requirements get implement. Prices are subject to change without warning. Speak to your income tax mentor getting income tax deduction recommendations.

Pre-House Collateral Financing

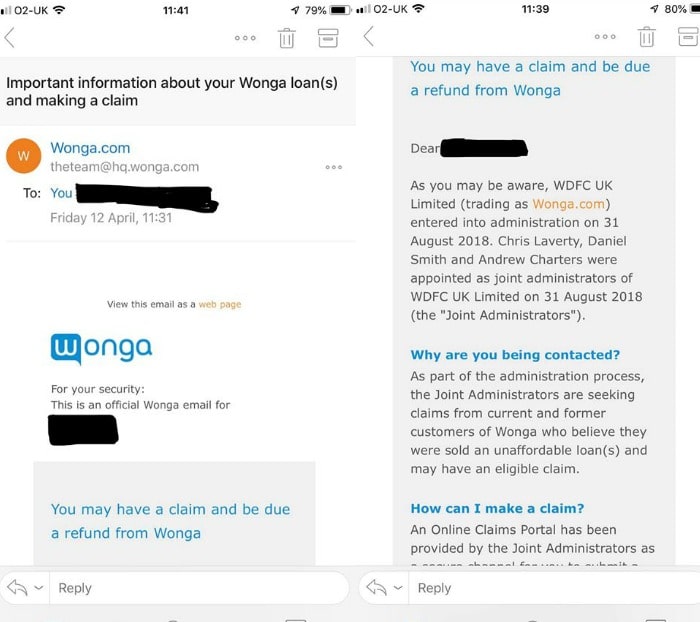

With recently purchased their new family, Patty and Bryan realized this would need specific try to its getting “theirs.” Into fundamental living https://paydayloancolorado.net/lamar/ components such as the home, cooking area and you may kitchen getting outdated, the couple chose to score a property security financing around to fund specific significant improvements.

The big Show

Patty and Bryan used their property collateral loan to provide their family a bit this new conversion! Improvements on their family room, cooking area and living area have made a life threatening affect new capabilities of the house for your family unit members. They currently have just the right event location to create thoughts having years into the future.

Why don’t you you?

Since the Patty and you may Bryan’s facts suggests, credit against the equity of your home is a big choice. But don’t care and attention-we will be along with you each step of one’s way.

Why don’t we Discover What’s You’ll be able to

Home guarantee financing are used for some thing aside from home improvements, as well. Make use of your residence’s value to cover college expenses, a new vehicles, unexpected bills plus. With financing rates still close historic lows, we can make it easier to borrow to 100% of your home’s worthy of, having terms and conditions to twenty years.** Over your application online, and you can an associate will be in contact to go over their borrowing alternatives and you may agenda an assessment to decide the appropriate being qualified conditions.

Household Fantasy Home

Buying your dream residence is one particular big lifetime milestones that you conserve to possess and you can dream about. For Patty and Bryan, their dream family ended up being that which have a tad bit more reputation than they’d to begin with forecast. Built in new eighties, it noticed their property just like the an investment and you may desired to offer they a small face-elevator so that they you are going to bring it to help you its full possible. To do so, it understood they would you would like a small amount of let financially, so they really turned to us for some assistance. Click on this link to read their complete facts.

Explore the possibilities

Playing with domestic collateral while making renovations come with high tax gurus. Given that household security financing offer straight down interest rates than simply of many scholar loans and you will handmade cards, they can be an easy way to cover a degree, funds a wedding otherwise consolidate high-attention debt.

Associate Worth Security

Once you apply for your property Guarantee Fixed Price mortgage, you might love to put Affiliate Worthy of Cover (MVP). This visibility commonly terminate your monthly premiums in the eventuality of death, disability, otherwise involuntary jobless-in place of punishment, extra appeal, otherwise dents to the credit report.

Unsure? Let’s Speak.

Credit resistant to the collateral in your home is a big choice. But never stress-we’re going to getting to you each step of your means. Use online and we’re going to get in touch with discuss your options.