Providers loan

You will find some style of team loan for every with various models from possessions made use of due to the fact safeguards. Unsecured business loans do not require one cover, and therefore tend to include higher costs.

Shielded business loans, rotating credit facilities and you can organization payday loans are also prominent types out-of providers mortgage. Whether or not they truly are a lot more of a form of revolving borrowing than just an excellent antique loan, charge fund, charge factoring and you can charge discounting are other style of funds one would be experienced.

When obtaining a business mortgage, the new economic efficiency of organization is key to your ability to succeed and you will loan providers will look at the levels and you may bank statements very carefully.

When you’re lenders takes a tight way elitecashadvance.com safe loan of unsecured loans, you might be able to increase your odds of victory because of the offering defense over assets, gadgets or assets.

There are trick loan providers on the market financing sector also Financial support Network, Start up Money, Lloyds Financial additionally the other standard finance companies.

Short-title financing

Short-identity funds is actually a type of name loan that’s arranged to own 12 months or faster. If you find yourself small-label funds are often unsecured as well as for degrees of ?step one,000 or smaller, connecting funds is actually a form of small-label financing and enable that acquire higher numbers.

Long-name mortgage

A lengthy-label financing could be considered that loan that’s paid more than five years or more. These types of money will be either secured or unsecured. The most used unsecured long-label loan is the unsecured loan, or unsecured business financing, while the popular shielded choices are secured personal loans, secure loans and mortgage loans. Provided that-label money believe in monthly costs over a longer time, loan providers will usually check your money and you may costs very carefully when you incorporate.

Financing facing property

Fund against property was a form of shielded mortgage and make use of your residence or other possessions just like the safety, tend to allowing you to use extra money, and at a lower interest rate. Just like the safety is being accessible to the lender, brand new lender’s standards can be smaller onerous than just is the case that have personal loans.

They may be always consolidate bills, improve funds getting home improvements, finance an unexpected costs and for organization aim.

Whenever securing that loan against your own house, it gets managed from the FCA, definition your selection of loan providers are quicker.

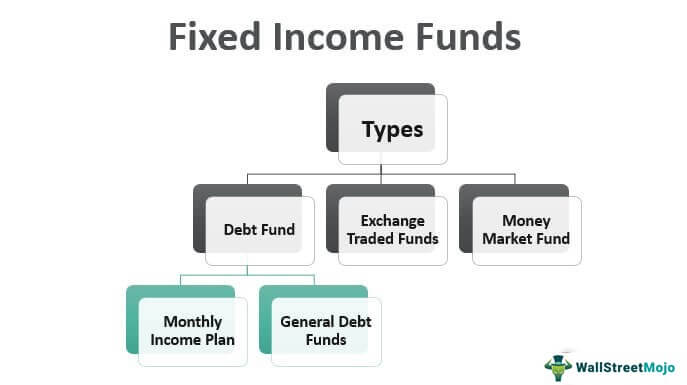

Finance Facing Fixed Places

Funds facing fixed dumps try a type of secure financing, which spends repaired put offers accounts because the guarantee, in return for a lower life expectancy price than simply is provided to your a consumer loan. Loans up against repaired places has actually a top enjoy level due to the kind of security considering along the repaired deposit account.

Just as in money secured facing shared finance and you will shares, finance against repaired deposits are primarily provided by pro personal banking institutions such HDFC Lender, HSBC Private Financial and ICICI Bank.

Auto financing

Auto loans try finance that will be accustomed support the purchase off a different sort of vehicles, particularly a motor vehicle, van or motorbike. This type of loans are usually a variety of unsecured personal loan, in the event when being ordered from the a business, advantage finance organization are happy to give a vehicle mortgage.

Auto money always utilize the auto while the guarantee, which could end in straight down interest levels and you will a top possibility out-of approval.

Flexi funds

Flexi money allows you to withdraw finance and you will pay them as expected to help your hard earned money move. These financing are unsecured, though there are covered flexi financing, particularly counterbalance mortgages. Although you can be draw down financing as needed, you need to stand in this a conformed credit limit that’s set when taking away a great flexi loan.