LIC HFL Construction Loans

Owning a home is actually a dream for many, but economic criteria are the most significant difficulties inside the finding it. Past providing economic security and lifetime chance publicity with assorted lifetime insurance policies and you will medical insurance plans, Term life insurance Agency regarding India opens the entranceway so you can bringing property financing, we.elizabeth., mortgage brokers.

LIC HFL Housing Funds Ltd. eases the journey of getting a property by providing that loan. LIC HFL has the benefit of mortgage brokers from the aggressive interest levels making sure that profit are not any extended limited so you can achieving your dream, and make otherwise upgrade your property. Learning to your, you will see regarding LIC household fund in more detail, along with eligibility standards, rates of interest, the program processes, and the ways to afford the LIC HFL loan amount on the web.

What exactly is LIC Homes Loan Eligibility?

All of the salaried personnel involved in authorities otherwise low-authorities sectors are eligible to avail of Lic HFL casing financing. The latest eligibility for a loan depends on multiple issues, including the income of one’s candidate, credit rating, loan repayment capability, nationality, etc. Listed here are the fresh new LIC houses mortgage qualification requirements one just one must fulfil to help you acquire the loan:

You need to use the new LIC HFL mortgage eligibility calculator, which is available into the authoritative site out of LIC Housing Money, lichousing.

The way you use LIC HFL Mortgage Qualifications Calculator?

The new LIC HFL mortgage qualifications calculator excellent from inside the understanding how much of a mortgage you might get on your own away from, depending on their qualification. This will help your sort the choices to check out almost every other info when the needed. payday loans near me Florida Below are the simple measures you could go after to make use of the brand new LIC HFL loan qualifications calculator:

- Go to the certified site of LIC Houses Money.

- Search down to Loan Eligibility Calculator, on the home webpage.

- Offer information, plus gross monthly money, full latest EMIs, interest, financing name, etcetera.

- According to the suggestions offered, the new qualified loan amount try presented off to the right, including more information for example month-to-month EMI and you will assets pricing.

Have and Benefits associated with LIC Domestic Loans

While wondering where you should rating a home loan away from, here are a few causes you can look at LIC Homes Loans:

Productive Documents

Event files will likely be a fuss. Which have LIC Construction Finance, we provide a sleek and you may effective records way to be certain that minimal documentation and shorter operating moments.

Home Service

LIC Property Fund now offers house solution (if necessary) to get more comfort. The agents can come for you to gather records, identify words, or assist with questions you’ve got.

Designed Qualification

Whether you’re a good salaried personal, self-employed top-notch, otherwise company owner, LIC HFL Homes Loans also offers funds for the certain need and you will economic potential.

Aggressive Rate of interest

LIC Housing Financing Ltd. also provides competitive interest rates making your residence loan inexpensive. They supply the finest financing options, guaranteeing your ideal away from owning a home is during reach without pushing your money.

Versatile Loan Tenure

You could potentially select loan period depending on your choice, such as for example a shorter tenure to reduce interest money otherwise a good longer period to reduce monthly instalments.

Look for Each Your preferences

LIC Houses Funds also offers various financial choice. Customers normally pick good LIC home loan, construction loan, extension, harmony transfer alternative, top-on mortgage, etc., predicated on its mortgage standards.

What’s the LIC Casing Money Interest rate within the 2024?

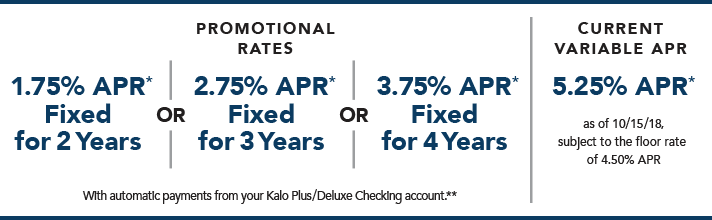

LIC HFL is renowned for giving mortgage brokers from the reasonable prices. The attention pricing consist of 8.35% per annum for home financing as high as Rs. 20 Crores which have versatile financing tenure between one year to 3 decades. The attention pricing for different types of pieces are listed below: