Heather Armstrong

The brand new first rung on the ladder is actually for marital possessions to get divided to the a factor. Although not, only a few monetary matters is actually black-and-white.

To attain a just and you will equitable shipments individual expense, in addition to industrial expense and you will silky funds away from friends and family, need to be meticulously noticed. Fund similar to this are going to be too difficult to separate on account of their nature, and sometimes things such as these will demand professional help out-of a good divorce case solicitor.

On this page, we’ll story what takes place to individual bills into the divorce or separation and you can describe people dilemma about your procedure. It is vital to bring separate legal services as soon as you can on your separation, in order for these exact things are dealt with efficiently and quickly. Yes, inside facts in which expenses try tall.

Just what are private expenses?

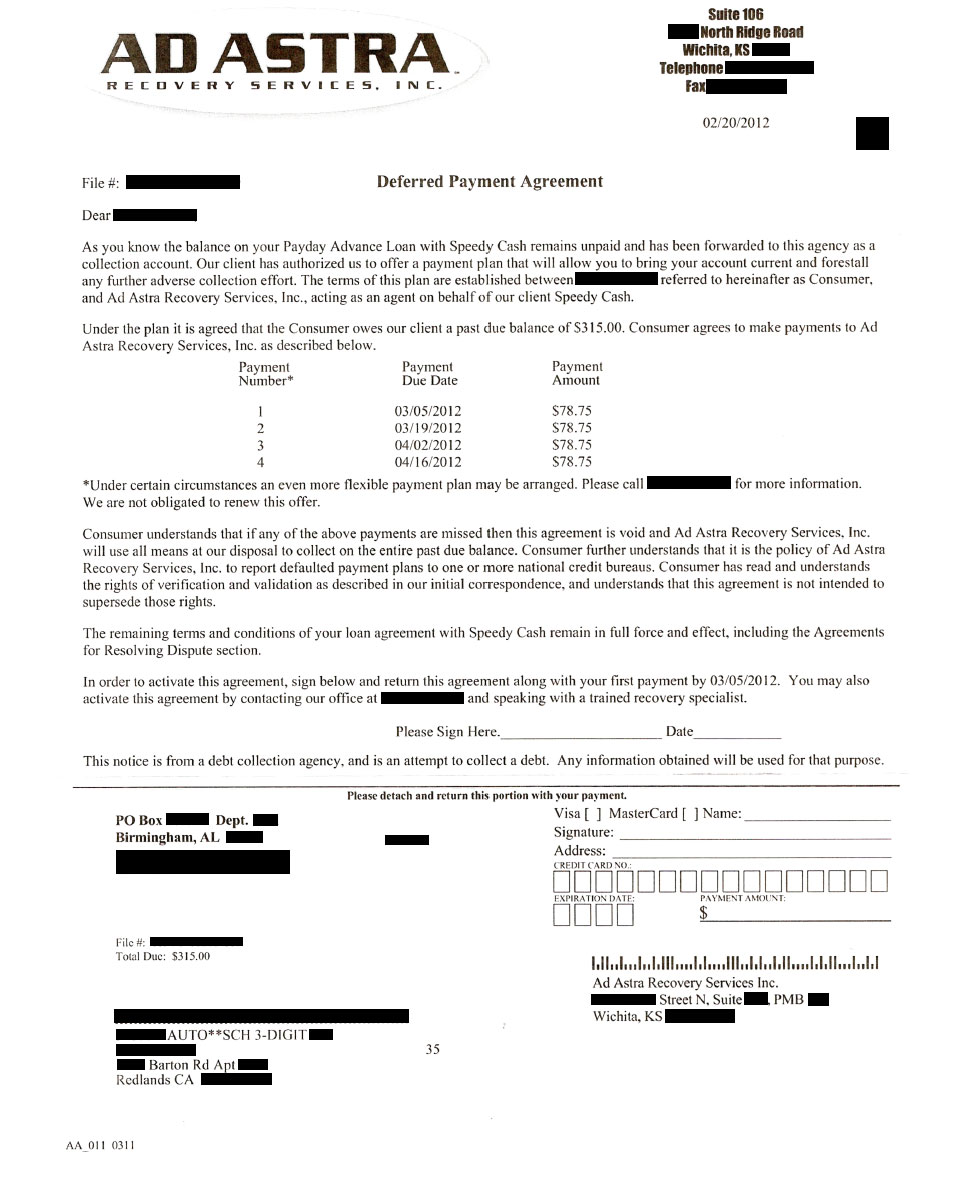

Debt makes reference to any money that an individual owes so you’re able to someone otherwise business. A few examples is figuratively speaking, mortgage loans, home collateral funds, auto loans, otherwise personal credit card debt.

Such expense try lawfully binding for the individual who got all of them out. Although not, it doesn’t mean that person whoever identity your debt is actually is in necessarily entirely duty for the entire personal debt.

Whenever you can establish that your particular ex-partner benefitted regarding unsecured loans beneath your title, they ought to be split up consequently as they begin to meet the requirements matrimonial bills, irrespective of the fact he could be in only one to spouse’s title.

Such as, you and your spouse age of just one partner, to cover a family group holiday or advancements on members of the family domestic, and therefore clearly you really have one another benefited regarding. Thus, it will be inequitable you may anticipate only the mate whose label the debt is within to-be exclusively responsible.

Get in touch

If you ever need assistance, or advice, with any problems that youre already facing please fill out your data from the setting at the end of web page, and a member of we have been around in touching.

When will it score difficult?

Have a tendency to family and friends render partners which have figures of cash when he is starting out or if it find themselves in economic difficulties. In respect out-of delicate finance from mothers these are will introduced to as being regarding the Bank of Mum & Dad.

Difficulties can occur with these fund because they are maybe not legitimately joining, as such. They truly are hard for the brand new courts to demand on account of its characteristics and you can decreased files.

Partners is to discuss paying these money to see whether they will be offset up against most other property of your own matrimony once they was sharing economic payment.

To locate a good settlement, particularly a payment plan otherwise asset transfer, its critical to be truthful and you will discover and you can go into full and you will honest financial disclosure together with your partner.

For those who have one evidence you one another provided to pay back including loans, , establish it on the divorce or separation solicitor. That is definitely a good option whenever stepping into eg plans which have family members and you will nearest and dearest so you’re able to write and you may signal a loan Arrangement to create away clearly this new regards to the mortgage, the quantity loaned, who its loaned to and from and terms of fees just in case people attention commonly accrue. This may create one thing smoother after down the road when given such soft fund within this divorce, as long as they arise.

Commercial debts, whether linked to a together had providers otherwise individual providers endeavour can truly add a separate layer away from complexity so you can divorce or separation.

People would be to perform an intensive listing of all industrial and you can business debts. And additionally information on lenders, the amount owed, plus the rates. It will help figure out which spouse accounts for for each organization financial obligation, prior to considering the allocation off requirements accordingly. This may differ based on which incurred your debt otherwise exactly how the money was used.

As with the newest section out-of other bills, this new section of company her latest blog costs between lovers will be discussed ranging from by the divorce proceedings solicitor or if perhaps suitable, mediated up on.

Even in the event a contract cannot be attained additionally the assets in case validate a credit card applicatoin so you’re able to Courtroom, after that an economic Option software might possibly be produced. Your own divorce proceedings solicitor have a tendency to advise you as to if or not this really is suitable. Alternatives are priced between performing a repayment package or an obligations import to at least one partner, once the suitable.

Wanting a separation solicitor ?

Ward Hadaway was pleased to have some of your region’s very knowledgeable divorce or separation lawyers based in Newcastle-upon-tyne, Leeds and you will Manchester meaning no hassle is actually ever too complicated. I plus frequently meet with clients and prospective clients remotely definition we can fool around with our assistance so you’re able to also let individuals who manage maybe not alive otherwise performs next to our very own practices. Please be connected to own a free, confidential discuss your situation and we’ll establish how exactly we can help.