Common Size Analysis of Financial Statements

It helps understand the nature of a company’s asset structure and sources of capital. It provides with each cost of goods sold, operating expenses, and net income as a percentage of total revenue and displays how expenses impact revenue as well as profit margins. The common size balance sheet reports the total assets first in order of liquidity.

Common Size Balance Sheet Statement

With regular financial statements, you would have line items listed as their total amounts. When it comes to common size financial statements, each line item gets expressed as a specific percentage of revenue or sales. One of the best examples of a common size financial statement is to take a look at the sales revenue on an income statement. Here, the common size percentages get calculated for each line item, and they’re listed as a percentage of the standard revenue or figure. Understanding income statements is vital because they depict a company’s financial performance over a reporting period.

Net Profit Margin

The common figure for a common-size balance sheet analysis is total assets. Based on the accounting equation, this also equals total liabilities and shareholders’ equity, making either term interchangeable in the analysis. It’s also possible to use total liabilities to indicate where a company’s obligations lie and whether it’s being conservative or risky in managing its debts. A common-size financial statement displays line items as a percentage of one selected or common figure. Creating common-size financial statements makes it easier to analyze a company over time and compare it to its peers.

Common size balance sheet analysis

It can also highlight the expense items that provide a company a competitive advantage over another. For example, a company might choose to gain more market share by sacrificing operating margins. However, a more popular version breaks down cash flow in a different way and expresses line items in terms of cash flows from operations. It will also include total financing cash flows and total investing cash flows for both of those activities. A company’s cash flow statement breaks down all of the uses and sources of its cash. It will typically get divided based on where the cash flow comes from.

An Example of Common Size Income Statement Analysis

Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program.

- It facilitates trend analysis and comparison of the financial statement over a period of time.

- This common-size income statement shows an R&D expense that averages close to 1.5% of revenues.

- To perform a common size income statement analysis, you’ll compare every line on your profit and loss statement to your total revenue.

- Notice that the $ can be inserted to anchor a cell reference, making it easier to copy and paste the same formula onto many lines or columns.

- Here, the cash represents $1 million of the $8 million in total assets.

Thus, the above common size income statement interpretation helps investors, analysts and management to identify challenges, opportunities and growth of the company. Common size vertical analysis lets you see how certain figures in your business compare with a selected figure in one given time period. For example, you might use it to see what percentage of your income fixed cost: what it is and how its used in business is used to support each business expense. Share repurchase activity can also be considered a percent of the total top line. Debt issuance is another important figure in proportion to the amount of annual sales it helps to generate. These items are calculated as a percentage of sales so they help indicate how much the company uses them to generate overall revenue.

With a common size horizontal analysis, you can easily see if, for example, your expenses increased as a percentage of revenue, stayed the same or decreased among different time periods. On the debt and equity side of the balance sheet, however, there were a few percentage changes worth noting. In the prior year, the balance sheet reflected 55 percent debt and 45 percent equity. In the current year, that balance shifted to 60 percent debt and 40 percent equity. The firm did issue additional stock and showed an increase in retained earnings, both totaling a $10,000 increase in equity. However, the equity increase was much smaller than the total increase in liabilities of $40,000.

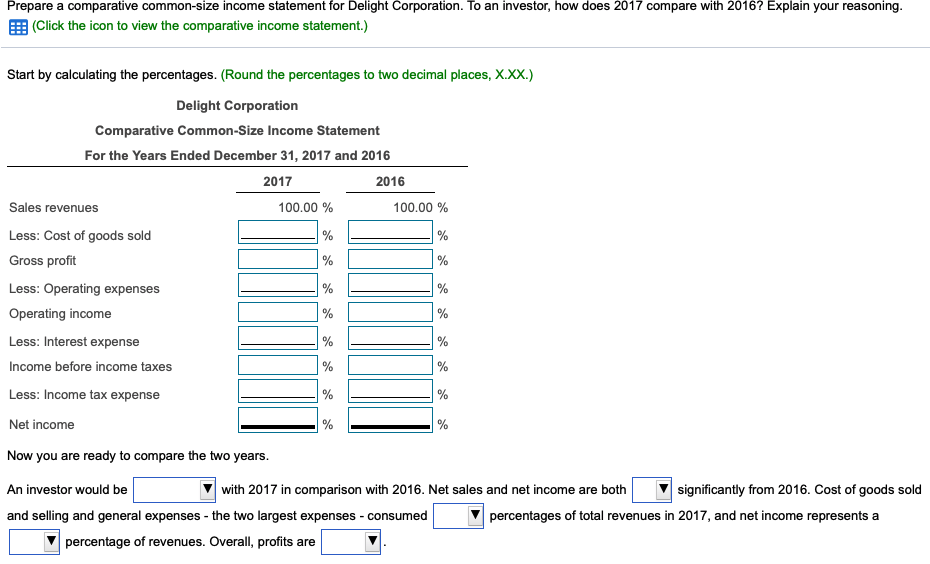

In the expense category, cost of goods sold as a percent of net sales increased, as did other operating expenses, interest expense, and income tax expense. Selling and administrative expenses increased from 36.7 percent in 2009 to 37.5 percent in 2010. It outlines and reports everything from liabilities, assets, and owner equity as a percentage of the sales or assets. Creating this type of financial statement makes for easier analysis between companies. Now let us understand how to calculate and prepare common size income statement the statement line items so that it represents each items a s a percentage of the sales made. For each line item on this sample income statement, we’ve shown the percentage that it makes up of total revenue.

Each line item on the balance sheet is restated as a percentage of total assets. Common size income statements with easy-to-read percentages allow for more consistent and comparable financial statement analysis over time and between competitors. The following example of company XYZ’s income statement and revenue and expense calculations helps you understand how common size income statement analysis works. Assets, liabilities and equity are presented as a percentage of total assets or total liabilities and equity.

On the other hand, common size financial statements give percent rather than absolute values and are easier to compare among firms or over time. The same process would apply on the balance sheet but the base is total assets. The common-size percentages on the balance sheet explain how our assets are allocated OR how much of every dollar in assets we owe to others (liabilities) and to owners (equity). Many computerized accounting systems automatically calculate common-size percentages on financial statements. The balance sheet of a company gives an overview of shareholders’ equity, assets, and liabilities for a reporting period. A common size balance sheet analysis gets created with the same rationality as the common size income statement.