Where Do you See Just what Apr Into A cards Provide Are?

When you get a charge card that offers spectacular rewards otherwise area redemption assistance, watch out such cards have a tendency to come with high APRs. In case your card gives you cash return for the every commands, travelling perks or any other great incentives, you’ll likely end up getting a higher Annual percentage rate to help you account for those can cost you.

Area

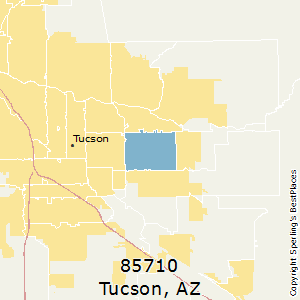

Place keeps an impact on your own Apr also, especially if you are getting an interest rate. Some other says and you can regional governments could have different statutes that could impact charge and other individuals will set you back might avoid upwards using, therefore switching their Annual percentage rate as well.

The scenario into the Credit Work (TILA) means loan providers to reveal the fresh new Apr regarding a loan otherwise credit credit before the debtor normally indication almost any price. While looking around having playing cards, just be capable of seeing initial in the promote what the latest Annual percentage rate each and every card is really you can contrast will cost you regarding other loan providers.

If you already have a credit card and you are clearly unclear exacltly what the Apr was, you can find methods for you to see. It ought to be noted on the monthly report, you could together with notice it by the logging into the account online and enjoying the details of your line of credit.

What makes Your own Apr High?

For individuals who looked the newest Annual percentage rate on your own charge card or mortgage out of fascination and you will was basically astonished at exactly how higher it actually was, you’re not alone. Of many consumers was mislead why the Apr was high than it believe it must be. Let’s opinion a number of explanations the rates would be high.

Loan Form of

When you have a loan, it might come with increased ple, personal loans eg specific personal loans will often have large APRs since the they’re not backed by almost any guarantee. Secured personal loans, on the other hand, constantly include lower APRs as the financing try backed by a piece of your house, such as property otherwise vehicles, which may be caught and you will offered in the event that you are not able to generate costs.

Handmade cards tend to come with high age reason just like the personal loans: there’s nothing in position to show you’re build your money timely. You’ll find such things as protected handmade cards, not, that enable you to prepay their personal line of credit amount to suit your lender to hang since equity. Since your lender features an easy way to recover its losses, should you stop making repayments, these notes tend to have straight down APRs.

Having said that, mastercard get Apr wouldn’t also amount for people who shell out their harmony off entirely monthly because you will not be billed into the a running equilibrium.

Reduced Credit rating

If you have imperfect borrowing, your credit score was adding to a leading Apr. Your credit score reveals loan providers how you treated your debts for the going back, just in case debt records might have been a small rugged, loan providers may only be considered your to have credit cards and you can financing with highest Annual percentage rate and come up with right up toward financing risk.

Financial obligation Stream

Loan providers together with check your obligations-to-money ratio, or DTI, to decide your Annual percentage rate. Your own DTI tips loan places Castleberry exactly how much debt you have when compared to the amount of money you’re taking home at the conclusion of brand new date. For those who have excessively debt, lenders are smaller willing to enable you to borrow cash once the you might be likely to neglect to make repayments. Extremely lenders choose your DTI was underneath the forty% diversity, but it is important to note that the low your own DTI, the lower Annual percentage rate you will be offered.