How to use a HELOC to invest in A residential property Opportunities

The key to Investing in Real estate

In terms of investing in a residential property, it is really not chump change you’re writing on. You prefer thousands of dollars saved up regarding very first financial support. Your money to close off is sold with the newest inspection will set you back, deposit, closing costs to cover fees, and you can pre-paid taxation and you can insurance coverage. Most of these are a rate of the purchase price and you will, thus, are different sizes.

So how am I carrying it out? Courtesy learning from your errors initially. I am starting to get my personal stride, and has now pulled couple of years. Initially, I thought it was about protecting all of the cent in order that you can purchase you to 2nd money spent. The secret you to I’ve discovered, even if, is that to create money, either you have to purchase your finances.

Grab, as an example, my personal duplex. We reinvested currency into assets in order to eliminate out more income about assets. An interesting attitude about any of it, in the morning I proper? Of the putting in a tiny more than $eleven,000 towards cosmetic improvements and you can timing the business right, I happened to be capable of getting the home reappraised for nearly $100,000 more I got myself they for. So it made me clean out my personal month-to-month mortgage payments by the $300/few days and enjoy us to take-out an effective HELOC to have $thirty five,000. This way, I enhanced my funding by the 3x and been able to simply take into an alternative venture who consistently assist me build my a property collection.

What’s Good HELOC?

A great HELOC means home security line of credit. Its a personal loan one to leverages the new security you really have inside an owning a home. That with a good HELOC, you, as a landlord, can borrow against the new collateral you have got when you look at the a property owing to using one minute financial. You need this type of financing to consider ideas, expenditures, consolidate debt, otherwise a number of other anything. The fresh new kicker? The dimensions of the HELOC is based on the level of collateral which you have of your house otherwise possessions.

Get, including, my multiple-family assets. You will find a $thirty-five,000 HELOC thereon possessions. Why is not it bigger? When i first purchased my duplex, We just set step 3.5% down. Immediately following and then make cosmetic makeup products reputation to my duplex and you will seeing new appraised beliefs out of a home go up typically, I had my property reappraised to improve off an FHA mortgage so you’re able to a normal loan, which may sooner let me lose my principal mortgage insurance policies (PMI). The extra security, theoretically, that had been reduced (otherwise, in this instance, appraised large) you are going to next be applied into the an excellent HELOC.

Guess The level of Your own HELOC

As with any finance, for every single bank enjoys other regulations and rules in terms of financial support. Hence their HELOC offering might look a while other. Fundamentally, loan providers are going to allows you to obtain a certain percentage of your own collateral of your home. So you’re able to estimate exactly what that matter might be, everything you need to manage are take your appraised value/purchase price and deduct your loan equilibrium.

After that, you’ll multiply the brand new fee that they are ready to financing you into the equity of your house. It then becomes your next financial. I recommend your consult with your mortgage administrator/home loan company to possess an excellent HELOC advice, also do a bit of browse oneself. That way you never curb your choices consequently they are able to maximize how big is their HELOC.

Could it possibly be Smart to Fool around with Good HELOC To spend?

The wonderful thing about an effective HELOC is that you haven’t to the touch they. It may be around should you need it in the upcoming, exactly as a safety net, otherwise leveraged to have a certain objective such as a married relationship. I know put a beneficial HELOC positioned in spring of 2020 just like the I was concerned about new housing marketplace and you may making a full time income. By using my duplex as an asset, I was in a position to safe a credit line from access to good HELOC once the a back up. Prompt toward 2021, and this HELOC will likely be used to protection some away from my bad credit payday loans guaranteed approval Maine personal investment expenses.

One more reason I enjoy HELOCs is that they normally are provided having seemingly similar interest rates in order to mortgage brokers with little to help you no closing costs. That it credit line rate of interest can be below signature loans and will getting very helpful when needing certain quick dollars for a renovation (otherwise one or two). There is essentially zero pre-payment punishment when you are able to pay-off the cash very early, and it can be used over and over repeatedly (for as long as the amount of money was rejuvenated). Additionally, untapped funds bear zero desire charges.

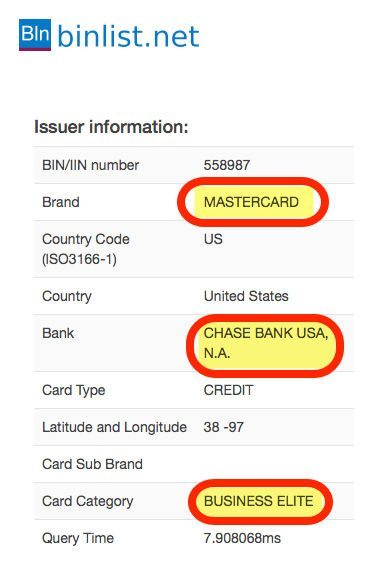

The simplest way to think about an effective HELOC is like good mastercard. You could potentially borrow money of it, repay it, after which borrow cash of it again. You may have a threshold, and you have to blow attract to your money you’ve lent or made use of. The advantage even in the event try credit cards tend to have twice thumb interest rates, when you are HELOC’s today () shall be safeguarded for anywhere between step 3%-5%.